Avanza operates in the Swedish savings market, which has one of the highest proportions of equity and fund investors in the world. The market has grown by an average of 7% a year in the last ten years. An estimated 80% of the population save in funds.

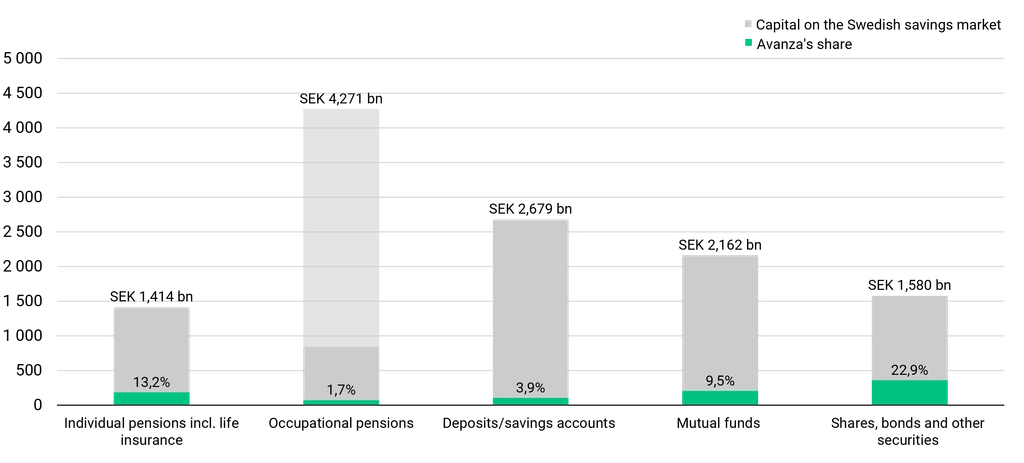

Avanza’s market share of the Swedish savings market is 7.7%, or 17.5% as a share of Sweden’s population. We see a potential by growing both the number of customers and our customers total savings capital at Avanza. Avanza's share of the total net inflow was 20,6% rolling 12 months.

There is a strong correlation between customer growth, growth in savings capital and income. Income in turn is driven and affected by:

- attractive offers

- market conditions such as trading activity, fund volumes and interest rates

- changes in deposit and lending volumes

The sensitivity in the event of a decrease in savings capital due to a stock market downturn is difficult to assess, as income is dependent on, among other things, how customers choose to invest their savings capital. To manage fluctuations in the market, the aim is to broaden the offering and increase the proportion of recurring revenues.

Factors that create good growth opportunities for Avanza

As social safety nets shrink, people are having to take more responsibility for their personal finances. The Swedish banking market is highly digital, which increases the demand for digital products and tools, gives changing customer behaviours as well as increased transparency and price consciousness. This is creating good growth opportunities for Avanza. Our aim is to broaden our offer and attract and help more people: experienced and established savers as well as new ones who need more support in their investment decisions.

We also see strong growth potential in occupational pensions, where Avanza has a very competitive offer. Our mortgage offer is an important piece of the puzzle as we go forward, which can also free up our customers’ savings capital with other firms.

In the last decade, we have attracted a large proportion of young customers. While they generally have less financial resources than older customers, there is a big potential if we continue to create the right offers and good reasons for them to stay with Avanza.