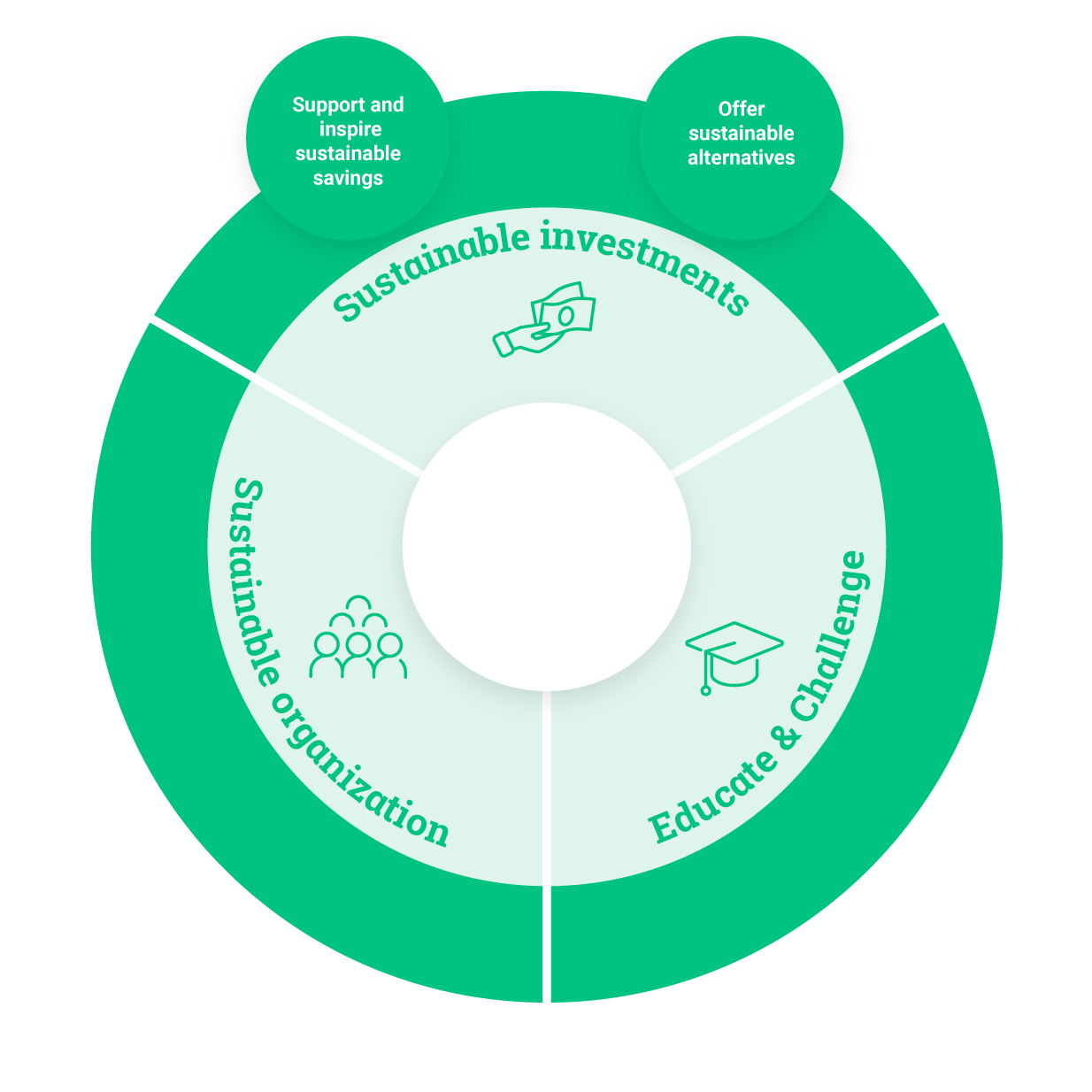

We want Avanza to be the obvious choice for those who want to save sustainably. Our aim is to offer a sustainable alternative in every product area, and one of our targets is to raise the ESG score of our customers’ investments.

It should be easy for our customers to identify and invest in sustainable choices. This requires that our product range can be analysed based on various ESG criteria, and over the years we have developed and implemented a number of tools and made ESG data available on the platform. To this point mainly for funds, and the fund list lets customers filter funds based on a number of ESG aspects. The ESG data comes from independent sources, mainly Morningstar and Sustainalytics.

Examples of our sustainability decision support:

The Nordic Swan Ecolabel ensures that funds are committed to ESG. The official ecolabel of the Nordic region, Nordic Swan is an unaffiliated non-profit working on behalf of the governments of Denmark, Finland, Iceland, Norway and Sweden.

The ESG Risk Rating is a visualisation we have added to the fund list so that customers can easily compare the ratings of various funds. Ratings are measured on a scale of 0–100, where a lower score means a lower ESG risk. A fund’s rating depends on whether it invests in companies that embrace sustainability and report their ESG work. The research firm Sustainalytics provides the company analyses and Morningstar then calculates an overall rating for the fund.

The Morningstar Sustainability Rating is also based on Sustainalytics’ analyses, which Morningstar uses to generate an overall rating. The rating is based on how the holdings in the funds manage risks associated with the environment, working conditions and governance issues relative to other funds in the same category. The rating is one to five, where five “globes” is the highest rating and means the lowest sustainability risk.

The Sustainability Label we developed enables customers to choose funds based on their personal preferences. This filtering tool helps them decide what is most important to them in four areas: Environment & Climate, Controversial Industries, Social Responsibility and Corporate Governance. In this way, customers can match funds with their personal choices.

Fund portfolio analysis – In “My fund portfolio analysis”, customers can analyse their funds by sector and holding, as well as by CO2 risk and how each fund’s companies work with ESG.