We want to be the obvious partner for those who want to learn more about personal finance and savings with a sustainability focus. We are committed to increasing gender equality in the savings market.

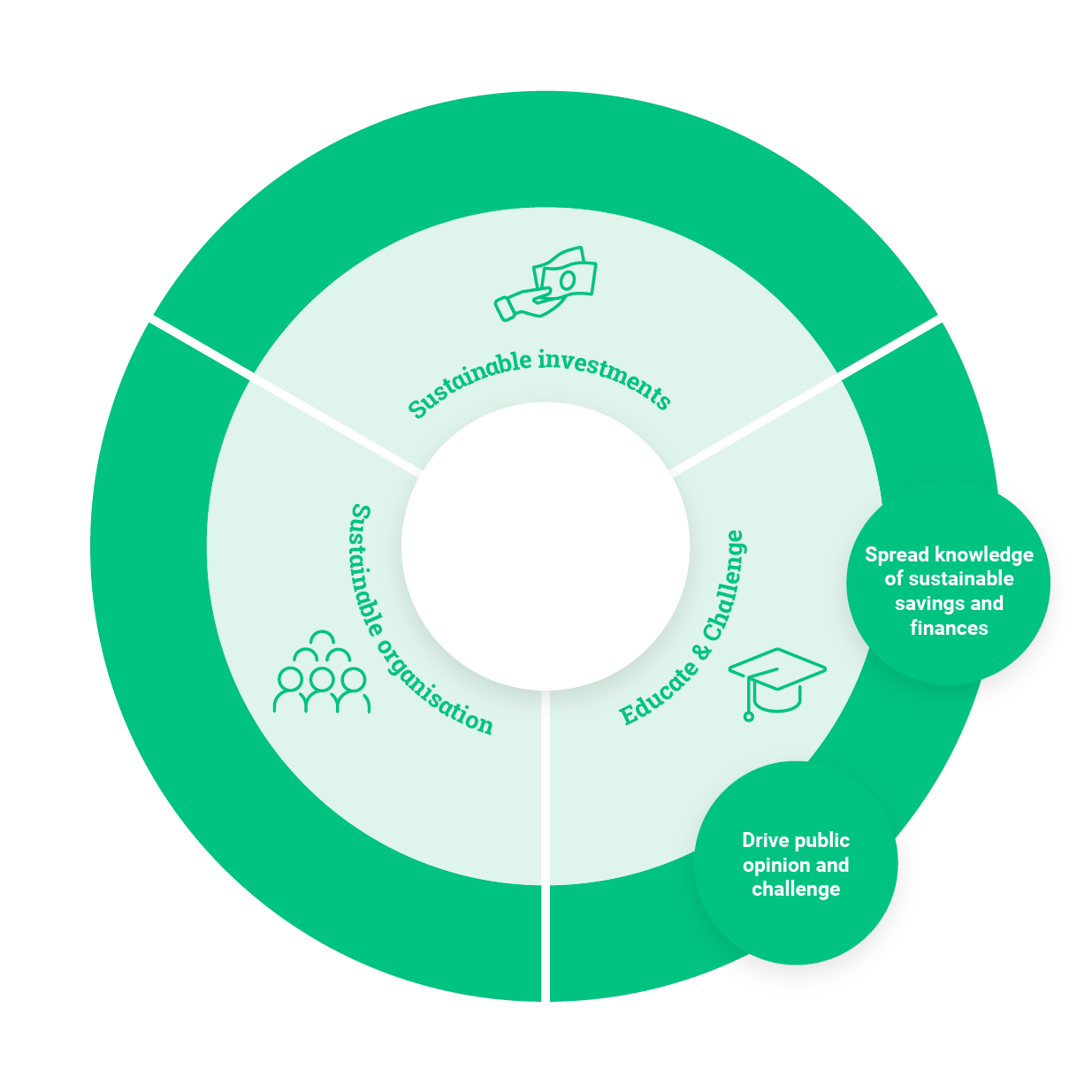

Since the start, we have tried to lower prices and increase transparency in the financial market, and to educate the public about personal finance. We are convinced that by educating and inspiring, we empower more people and increase the share of savings capital that is invested sustainably. In addition, we are pushing gender equality forward in the financial market.

Our savings economists advocate for savers and challenge established structures that don’t fully benefit consumers. On our website, we educate and inspire through the Avanza podcast, Avanza blog and Avanza Academy, among other platforms. In all these forums, we work with an inclusive language and a focus on sustainability and gender equality. The blogs and podcast release updated features on personal finance, the stock market, how to start saving and new functions on the platform. The Academy teaches savers what to think about when choosing stocks, funds and other securities, and how to build various types of portfolios. There are also answers to questions on taxes and tax returns. Avanza has released two audiobooks on personal finance, Savings School and Stock School, in collaboration with the publisher Storytel, both of which have been well received.

Contributing to gender equality in savings is critical to our sustainability work and increased gender equality in savings is one of our three overarching sustainability targets. We work actively to reach broader target groups and to encourage women to save. While interest in stocks among women is rising, six out of ten shareholders are still men.

What we are doing

- Building opinion by regularly publishing data on the gender savings gap, both in terms of Avanza’s customers and at a national level.

- Prime mover in a network established collaboratively by the public and private sector to share knowledge and discuss measures to encourage more women to save. As part of the network, a lecture tour is held to spread savings information.

- Campaigns in traditional media, podcasts and social media that mainly target women and inspire and motivate them to save.

- The Start offer, where fees are refunded to customers with savings of less than SEK 50,000, is increasingly popular with women.

At a time when many people are falling into debt, knowledge and insight into personal finance are essential. We sit on the program board of the Swedish National Network on Financial Education, which is coordinated by the Swedish Financial Supervisory Authority, to improve financial literacy through various information and educational initiatives.