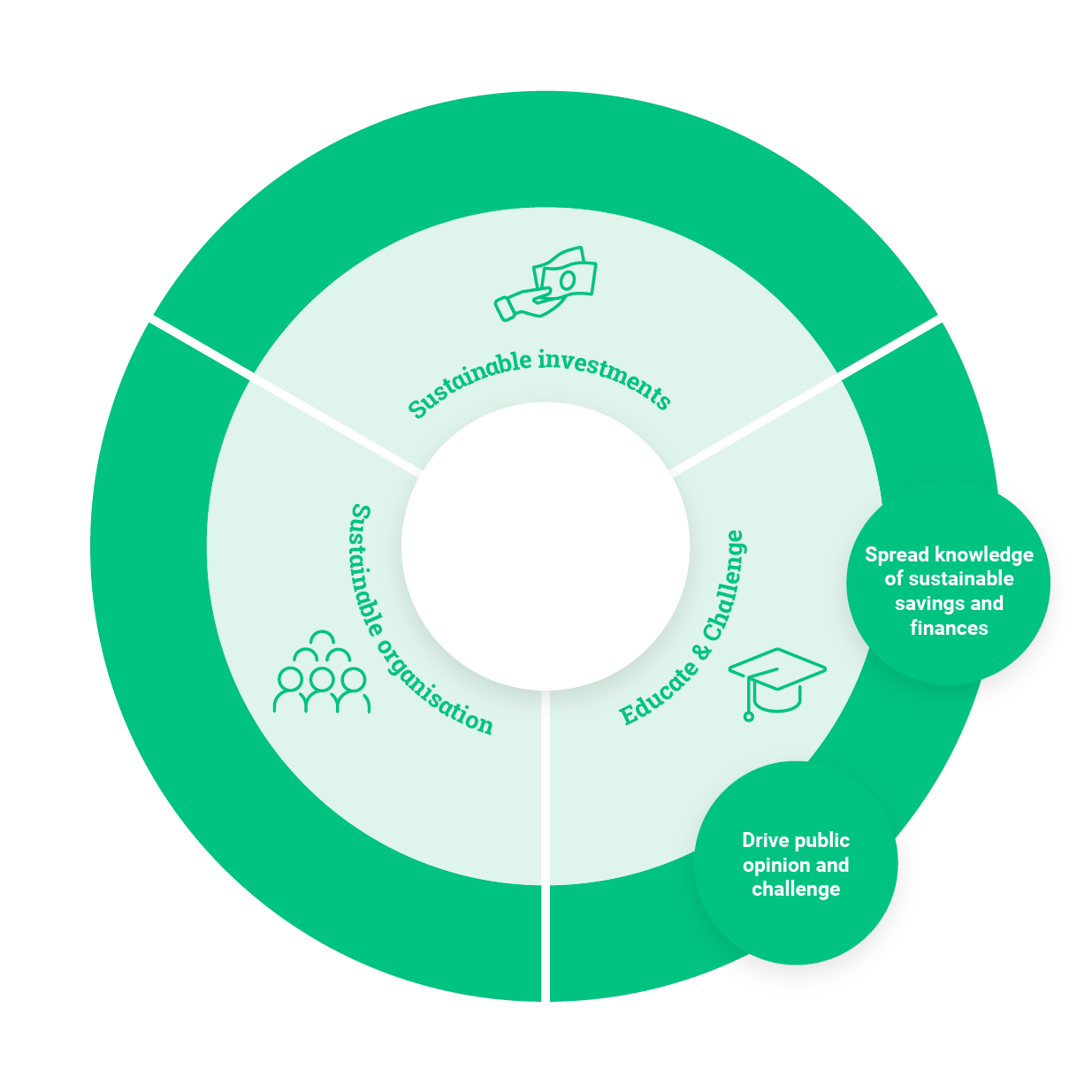

Since the start, Avanza has worked to reduce prices and increase transparency in the financial market and to promote financial literacy. Our belief is that through responsible products and terms, user-friendly tools, and by educating and inspiring, we help more people become financially independent.

We work daily to teach financial skills to the public. By providing free and open education on savings and investments, we make it possible for anyone to learn how to become more financially independent and build a secure future. Our savings economists bring issues involving savings, investments and personal finance to the media’s attention and make these questions become part of the public debate. We advocate for change and challenge established structures

that do not benefit savers.

Contributing to gender equality in savings is critical to our sustainability work and increased gender equality in savings is one of our three overarching sustainability targets. We work actively to reach broader target groups and to encourage women to save. While interest in stocks among women is rising, six out of ten shareholders are still men.

The Avanza Academy is a how-to savings guide containing basic knowledge about financial concepts, terms and trends as well as timeless information to guide our customers on what to consider when choosing stocks, funds and other securities, as well as how to build various types of portfolios. There are also answers to questions on taxes, mortgages, cryptocurrencies and sustainable savings.

In the Avanza blog and Avanza podcast, in-depth information is mixed with basics for beginners. The content changes based on what is happening at the moment in order to build a broader understanding of what to think about when economic conditions change. Novelty and variation in the content keep us relevant for every level of knowledge, whether active investors or new savers.

We always strive to be as close to our customers as possible, why we maintain an active presence on social media. We communicate daily with customers via X, Facebook, Instagram, YouTube and TikTok.

Partnerships, memberships and networks

- Swedish National Network on Financial Education

- Ung Privatekonomi

- ECPAT Sweden

- Introduce a Girl to Engineering Day Q Women Engineering Day