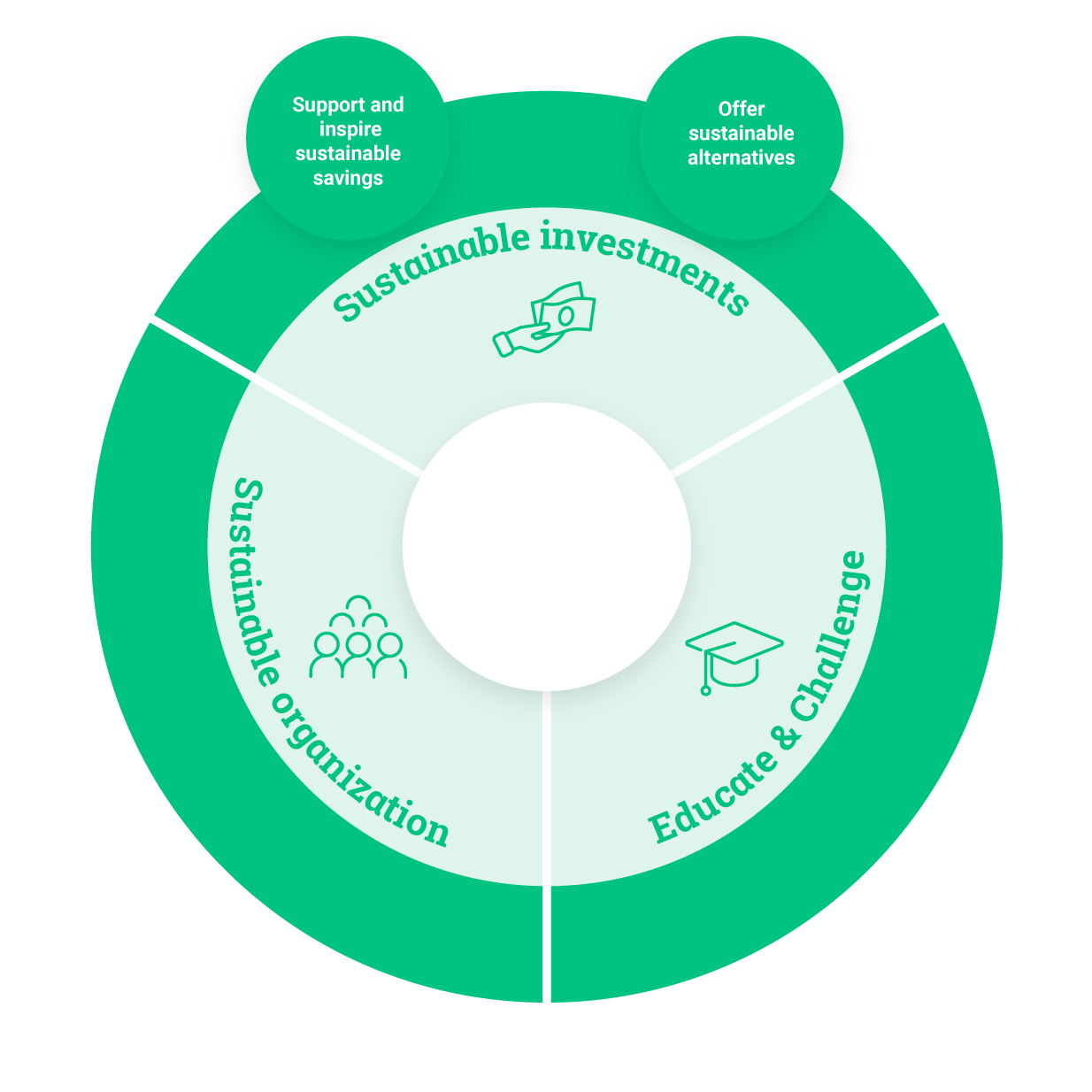

We want Avanza to be the obvious choice for those who want to save sustainably. Our aim is to offer a sustainable alternative in every product area, and one of our targets is to raise the ESG score of our customers’ investments.

It should be easy for our customers to identify and invest in sustainable choices. This requires that our product range can be analysed based on various ESG criteria, and over the years we have developed and implemented a number of tools and made ESG data available on the platform. The ESG data comes from independent sources, mainly Morningstar and Sustainalytics.

Examples of our sustainability decision support:

The Nordic Swan Ecolabel ensures that funds are committed to ESG. The official ecolabel of the Nordic region, Nordic Swan is an unaffiliated non-profit working on behalf of the governments of Denmark, Finland, Iceland, Norway and Sweden.

The ESG Risk Rating is a visualisation we have added to the fund list so that customers can easily compare the ratings of various funds. Ratings are measured on a scale of 0–100, where a lower score means a lower ESG risk. A fund’s rating depends on whether it invests in companies that embrace sustainability and report their ESG work. The research firm Sustainalytics provides the company analyses and Morningstar then calculates an overall rating for the fund.

The Morningstar Sustainability Rating is also based on Sustainalytics’ analyses, which Morningstar uses to generate an overall rating. The rating is based on how the holdings in the funds manage risks associated with the environment, working conditions and governance issues relative to other funds in the same category. The rating is one to five, where five “globes” is the highest rating and means the lowest sustainability risk.

Fund portfolio analysis – In “My fund portfolio analysis”, customers can analyse their funds by sector and holding, as well as by CO2 risk and how each fund’s companies work with ESG.

Filters make it possible to identify funds based on whether their investments align with the SDGs or whether it is an Article 9 or 8 fund according to the EU’s Disclosure Regulation.

KPI’s associated with sustainability on the stock pages simplify sustainable investment decisions on stocks. There is information on whether the companies have revenues from economic activities that contribute to the SDGs and whether the company has revenues from controversial industries. There is also sustainability data on how far the companies have come in terms of gender equality of their boards, management and workforce in general.